Retroactive Tax Credits 2024 Neet Application – Child tax credits are likely to be expanded thanks to a $78 billion tax agreement between the Democrat-led Senate Finance Committee and the Republican-helmed House Ways and Means Committee. . Under the proposed legislation, the child tax credit would increase the maximum refundable child tax credit to $1,800 for 2023 tax returns, $1,900 for the following year, and $2,000 for 2025 tax .

Retroactive Tax Credits 2024 Neet Application

Source : www.slideshare.net

eolas Magazine issue 61 Jan 2024 by bmf business services Issuu

Source : issuu.com

Sprint Retrospective : Meeting, Purpose and Steps GeeksforGeeks

Source : www.geeksforgeeks.org

Stanley Morgan Industries adopted a defined benefit pension plan

Source : www.slideshare.net

eolas Magazine issue 61 Jan 2024 by bmf business services Issuu

Source : issuu.com

Stanley Morgan Industries adopted a defined benefit pension plan

Source : www.slideshare.net

Insurance Wiclplapp 01 2016 2024 Form Fill Out and Sign

Source : www.signnow.com

Retrospective in Agile GeeksforGeeks

Source : www.geeksforgeeks.org

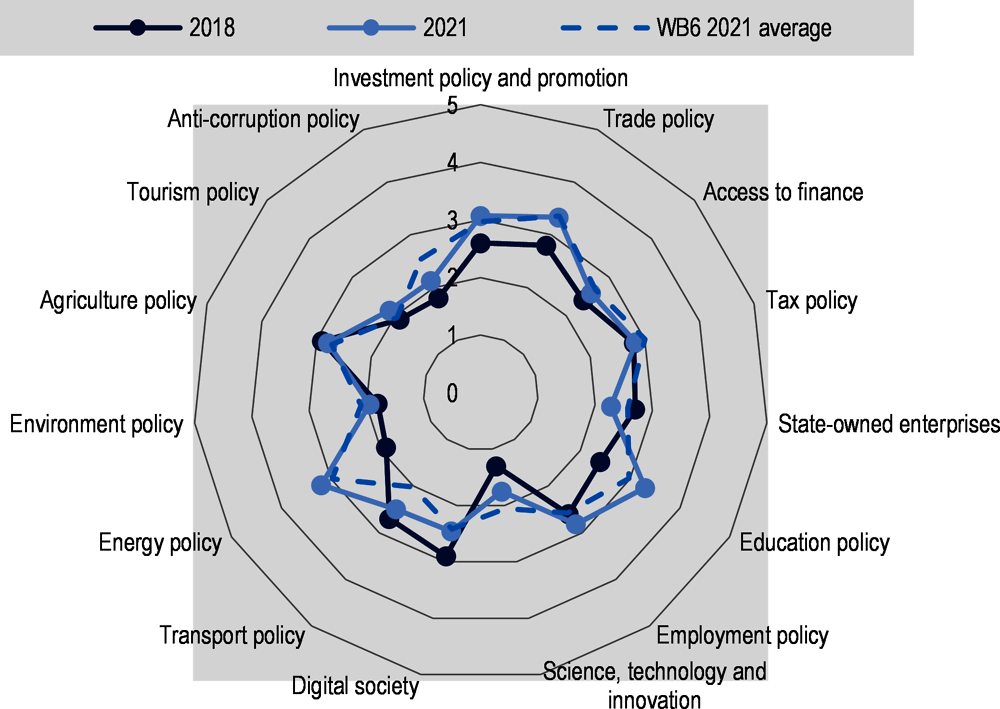

20. Albania profile | Competitiveness in South East Europe 2021

Source : www.oecd-ilibrary.org

What Should You Do If You Missed The Extended Tax Deadline

Source : damienslaw.com

Retroactive Tax Credits 2024 Neet Application Stanley Morgan Industries adopted a defined benefit pension plan : the EV tax credit allows eligible taxpayers to claim a maximum credit of $7,500 for new EVs, and up to $4,000, limited to 30% of the sale price, for used EVs. Starting on Jan. 1, 2024, eligible . For 2023 tax year, the maximum tax credit available per child is $2,000 for each child under 17 under Dec. 31, 2023, CNET reported. If you are eligible, it could reduce how much you owe in taxes but, .